Do I Need an Accountant? When to Hire an Accountant (& When to DIY)

Posted on: January 15, 2025

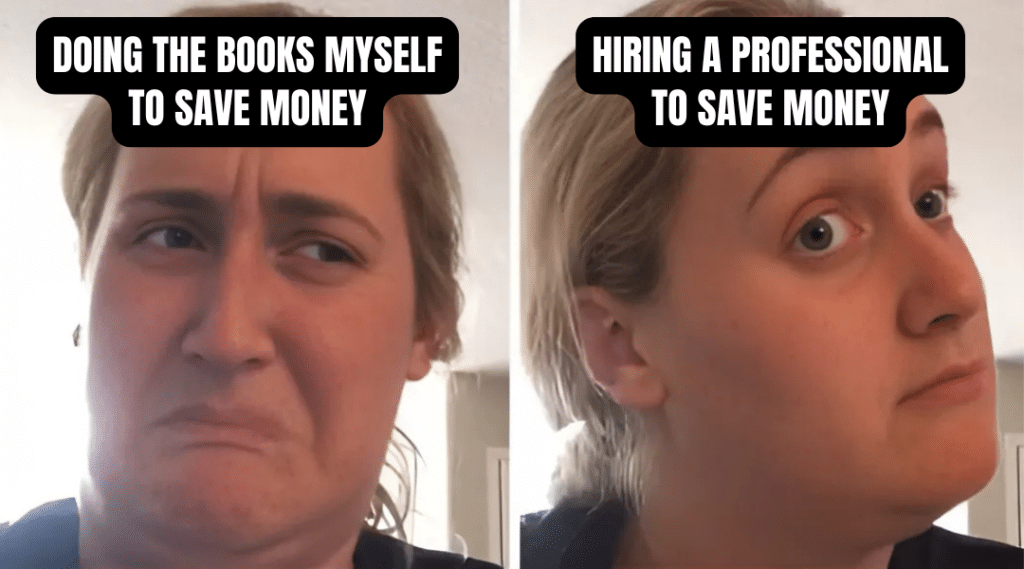

Can you juggle running your business and managing your finances? Spoiler: even the best jugglers drop the ball sometimes. Running a small business means wearing a lot of hats: owner, marketer, salesperson, and—yes—accountant. It’s easy to feel overwhelmed when trying to keep up with clients, invoices, taxes, and everything in between. Somewhere along the way, you’ve probably asked yourself, “Do I need an accountant, or can I just DIY this whole finance thing?”

It’s a valid question. After all, every dollar matters, and hiring help isn’t always an obvious choice when operating a small business.

So… do you need an accountant for your small business? The short answer is: it depends on your business’s size, complexity, and your personal comfort level with numbers. The longer answer? Well, grab a coffee and settle in. We’re diving into when it’s okay to fly solo and when it’s time to call in the pros.

When You Don’t Need an Accountant (Yet)

Honestly, if you’re running a little side hustle or a brand-new small business, you can probably get by without one (for now). But it’s not a one-size-fits-all answer, either. Here are some situations where it might make sense to fly solo:

1. Your Business is Simple

If you’re a sole proprietor with minimal expenses, straightforward income, and no employees, managing your own finances might not feel overwhelming. Wave is a free option which can help keep you organized. Google Sheets or Microsoft Excel are also viable options for simple operations. Accounting software options such as Xero or QuickBooks Online (QBO) are a bit more substantial, but also a little more costly. Click here to learn about our professional bookkeeping services.

2. You Love Numbers

Some people are spreadsheet wizards who actually enjoy reconciling bank statements. If that’s you, and you understand the basics of bookkeeping, tax rules, and financial reporting (and you have the time to do it)… why didn’t you become an accountant? Just kidding. But seriously—in this scenario, you might not need an accountant… yet.

3. You’re in Startup Mode

In the very beginning, every dollar matters. If hiring an accountant feels premature and you’re confident you can handle basic compliance (like filing GST/HST returns and meeting tax deadlines), you might manage just fine without one.

But let’s be real: even in these situations, you’ll still need to know when to call for backup. And just because you can handle something alone doesn’t mean you should do it forever.

Signs It’s Time to Hire an Accountant

Ah yes, the dreaded “uh-oh” moment—when your financial situation evolves beyond your expertise. Don’t worry; this isn’t a bad thing—it likely means your financial situation is improving! Here are some obvious signs it’s time to bring in a pro:

1. Your Time is Better Spent Elsewhere

If you’re spending hours on bookkeeping instead of growing your business, you’re losing money in the long run. Think of it this way: would you rather spend 10 hours sorting receipts or 10 hours landing a new client? The choice is obvious. Hiring someone to handle the numbers will free you up to focus on actually making more money.

2. Your Taxes are Getting Complicated

Canadian tax rules are no joke. From GST/HST to payroll taxes, there are plenty of opportunities to make expensive mistakes. Having a Chartered Professional Accountant (CPA) on your side ensures you’re taking advantage of all the deductions you’re entitled to while avoiding penalties for errors or missed deadlines.

Example: Did you know businesses can deduct a portion of home office expenses if you work from home? But figuring out what counts—and how much—isn’t always straightforward. An accountant can handle this while you focus on the big picture.

3. You’re Growing (Woohoo!)

Hiring employees, opening a second location, or scaling your operations? Congrats! But more growth means more complexity. In the wise words of Biggie Smalls, “More money, more problems.” Payroll, benefits, inventory, and cash flow management can quickly overwhelm even the most organized entrepreneur. An accountant can help you navigate these challenges with ease.

4. You’re Making Big Decisions

Thinking about buying or leasing equipment, applying for a loan, or bringing on a partner? An accountant can help you crunch the numbers, forecast outcomes, and ensure you’re making decisions that align with your finances and long-term goals. Think of CPAs as quarterbacks: they run interference on potential financial missteps and are MVPs when it comes to identifying when additional professional services are required (in any regard). They serve as a constant, reliable touchpoint when you find yourself making big business decisions, questioning your finances, or when you simply find yourself scratching your head.

Serious about scaling? You’ll need someone who can provide strategic tax and finance guidance to help pave your path to profitability (and not all accounting firms are built equal). At NowCPA, we do more than just crunch numbers. Get started today.

5. You Want Peace of Mind

Even if you’re confident in your financial abilities, the comfort of knowing a professional is keeping things in order is priceless. An accountant can spot errors, offer strategic advice, and keep you on track—so you can sleep better at night. DIY’ing doesn’t always mean saving money (sometimes it can end up costing you a lot more). Hiring a pro could potentially save you thousands in the long run.

What an Accountant Does For Your Business

Hiring an accountant isn’t just about keeping the books balanced; it’s about unlocking the full potential of your business. Since an accountant is constantly engaged in (and reviewing) your finances, they have a crystal-clear view of what’s going on financially in your business. This helps them see (and catch) things you may miss—such as opportunities or potential risks.

Here’s what CPAs bring to your business:

1. They Give Expert Advice

CPAs don’t just crunch numbers—they’re strategic advisors. They can pinpoint opportunities to save money, improve profitability, and help you plan for the future you want.

2. They Make Compliance a Breeze

Compliance can be a pain and, let’s face it, is boring. There, we said it. From corporate tax filings to Canada Revenue Agency (CRA) audits, an accountant ensures you’re following all the rules and avoiding costly mistakes so you can focus on more revenue-generating (and interesting) tasks.

3. They Save You Time

By outsourcing your financial management, you can reclaim hours of your week to focus on growing your business—or, let’s be honest, taking that much-needed breather. And that’s priceless. Here is a great article on the benefits of outsourcing your financial operations. The sooner you do this, the better off your business will be.

4. They Provide Financial Clarity

An accountant helps you understand your numbers so you can make informed decisions. Your business numbers tell a story, and accountants are the best translators. Whether it’s understanding your profit margins or preparing for tax season, they provide valuable insights unique to your business.

How to Find the Right Accountant

Okay, maybe this article has led you to decide it’s time to hire an accountant. But how do you find the right accountant to meet your needs? Here are our best tips:

- Look for Industry Expertise

Every business is unique, so it helps to find an accountant who understands your specific challenges. Whether you’re in retail, construction, or tech, industry expertise matters. - Check Their Credentials

In Canada, look for Chartered Professional Accountants (CPAs). They’re held to high standards and have the training to handle complex tax and financial situations. - Ask for Referrals

Your network is a goldmine. Ask other successful business owners who they trust with their books. - Find Someone You Can Trust

You’ll be sharing a lot of sensitive information, so find someone you feel comfortable working with. A visit to your accountant’s office should feel relaxed – not like a visit to the principal’s office.

Our CPAs are cool – we promise. Click here to schedule an appointment with one of our CPAs.

Do I Need an Accountant for My Small Business?

The bottom line: If you are a sole proprietor or your business is simple/small, you might be able to handle things yourself (for now). But as your business grows (or if you incorporate), so do your financial responsibilities. Making the decision to hire an accountant can save you time, reduce stress, and ultimately make your business more successful.

Remember, you don’t have to do it all alone. Whether you’re shooting for the stars or happy with where you’re at, an accountant can help you stay balanced and focused on what matters most—so you feel good about your finances and the state of your business.

So, do you need an accountant? If it helps you sleep better at night—absolutely. Or, if you’re feeling the weight of the world on your shoulders (and feeling alone when it comes to running your business), seeking professional help can provide massive relief.

Still not sure? Start with a free consultation – at NowCPA, we’re here to help business owners navigate numbers and smash their business goals. Let’s figure out how we can support you – no strings attached. Get started here.