CRA Tax Payments Made Easy: An Essential Guide for 2024

Posted on: February 7, 2024

How to Pay Business Taxes in Canada

If you have any experience paying taxes, you will know that paying CRA is harder than it may seem. Paying your personal tax is simple: just add CRA as a payee via your online banking to make your CRA tax payments online, or print a remittance voucher with your return.

But, paying through a corporation is much more difficult. We’ve made it easy.

What are your options for making CRA tax payments for your corporation?

You can find a complete list of payment options here. But our recommendations are as follows:

- Pay CRA online via your online banking (see below for how to set this up)

- Pay CRA at the bank (you will need a personalized remittance voucher directly from CRA to do this – cumbersome, I know!)

- Pay CRA by cheque in the mail (only if your payment is less than $10,000 – otherwise there will be penalties!)

Set up your online banking to make CRA tax payments via “Government Payment & Filing Service”

Because this is our recommended approach, we will explain in detail how to set this up.

Banks offer a convenient tool to make government payments online called “Government Payment & Filing Service”. There is a cost to the service, but the convenience is definitely worth it. The cost of the service is typically as follows (note, some banks do not charge additional fees for this service):

- $19.95 enrollment fee

- $2 per payment

- $1 per month that the service isn’t being utilized

Once you are enrolled, depending on your financial institution, the service can be accessed via a link on your Corporation’s online banking (although, we would recommend bookmarking a direct link for convenience).

To make a tax payment, you will first need to add the appropriate payee. Once added, the payee will remain on your list of “Registered payments and accounts”, making future payments seamless.

In this article we cover adding payees and making payments for each of the following taxes:

- Federal Income Taxes Balance Owing (year-end tax payment)

- Alberta Income Taxes Balance Owing (provincial year-end tax payment)

- Payroll Source Deductions

- Tax Instalments

- GST

Income Tax – Balance Owing (Federal & Provincial)

This account relates to the balance owing when income taxes are paid. If you are paying after your year-end date (either before or after the return has been filed), you would use this account.

To Pay Federal Income Tax Balance Due

- Ensure the payment type “TXBAL” (Federal – Corporation Income Tax Balance Due) has been added to your Government Tax Payment & Filing Service

- Select “TXBAL” and click “Pay”

- On the Corporation Income Tax Balance Due Form

- Period ending: This should be the applicable year-end date for the taxes you wish to pay

- Payment amount: Enter the amount you wish to pay

- Payment date: Enter the date you wish the payment to be made. The earliest it can be is the next business day, but it can also be some date in the future.

To Pay Alberta Income Tax Balance Due

- Ensure the payment type “AT 1” (Alberta Finance – Corporate Income Tax) has been added to your Government Tax Payment & Filing Service

- Select “AT 1” and click “Pay”

- On the Alberta Finance – Corporate Income Tax Form

- Period ending: This should be the applicable year-end date for the taxes you wish to pay

- Payment amount: Enter the amount you wish to pay

- Payment date: Enter the date you wish the payment to be made. The earliest it can be is the next business day, but it can also be some date in the future.

Payroll – Monthly Source Deductions

This account is for monthly source deductions for wages paid in each month. The source deductions are due by the 15th of month following the month in which the wages are paid.

To Pay Source Deductions

- Ensure the payment type “PD7A” (Federal Payroll Deductions – Regular/Quarterly – EMPTX) is added to your Government Tax Payment & Filing Service

- Select “PD7A” and click “Pay”

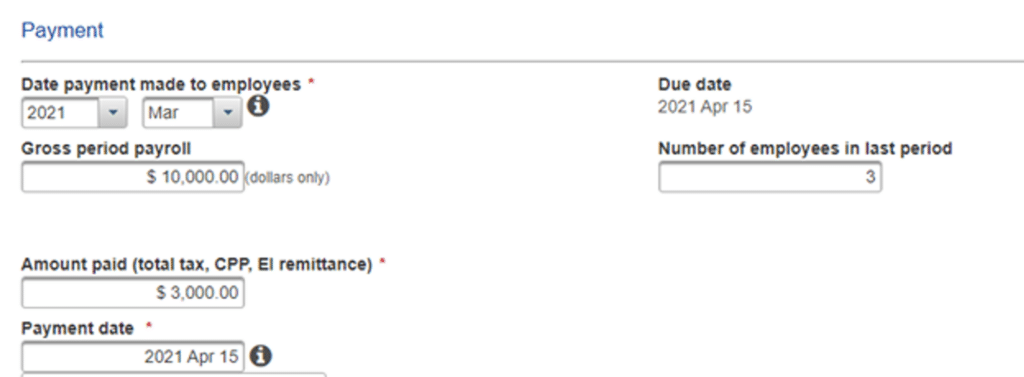

- On the Payroll Deductions Form

- Date payment made to employees: Select the year and month of the actual date the employees were paid. Note once you have selected the year and month, the Due date should populate – which should be the expected due date for the period you are remitting. (Example: For January 2021 wages which are due Feb 15, select “2021 January”)

- Gross period payroll: This should be the total Gross Wages paid in the period (before deductions have been taken off)

- Number of employees in last period: Enter the total number of employees paid in the period.

- Amount paid: This is the amount you are remitting for total source deductions

- Payment date: This is the date that you would like the payment to come out of the account. The earliest it can be is the next business day, but it can also be some date in the future.

- Enter Next, Submit

- See the screenshot below for an example where I am paying $10,000 to 3 employees for the March 31, 2021 period due on April 15.

Income Tax – Instalments (Federal & Provincial)

This account is for Income Tax instalments. Essentially, when a business is over a certain net income threshold, income tax instalments are required for the subsequent year. Instalments are a pre-payment of taxes owing. When the tax return is filed, the instalment balance is applied against the tax payable resulting in either a refund (if the instalments are greater than the taxes payable) or a balance owing (if the instalments are less than the taxes payable).

To Pay Federal Tax Instalments

- Ensure the payment type “TXINS” (Federal – Corporation Tax Payments) has been added to your Government Tax Payment & Filing Service

- Select “TXINS” and click “Pay”

- On the Corporation Tax Payments Form

- Period ending: This should be the applicable year-end date for the taxes you wish to pay. If you are making instalments, the period end is usually (but not always) your next year-end. For example, if the current date is September 23, 2023, and your year-end is December 31, this payment would be for the December 31, 2023 Period ending.

- Amount owing: If you are making an instalment payment, this number should be $0

- Interim: This is where the instalment payment should go. Enter the Federal instalment amount you wish to pay

- Payment on filing: This is not applicable for instalments, this number should be $0

- Payment date: This is the date that you would like the payment to come out of the account. The earliest it can be is the next business day, but it can also be some date in the future.

- Enter Next, Submit

To Pay Alberta Tax Instalments

To pay Alberta Instalments, follow the instructions on how to pay Balance Owing, but instead select the year-end date as the period that you wish to apply the instalment towards.

GST Payments

This account is for making GST payments upon filing your GST return.

To Pay your GST

- Ensure the payment type “GST-B” (Federal – GST/HST Balance Due) is added

- Select “GST-B” and click “Pay”

- On the GST Balance Due Form:

- Period ending: This should be the applicable GST reporting period end date for which you are making a payment

- Payment amount

- Payment date: This is the date that you would like the payment to come out of the account. The earliest it can be is the next business day, but it can also be some date in the future.

- Enter Next, Submit

GST-B vs GST-P

- GST-B – GST Balance Due

- GST-P – GST instalment payment

TXBAL vs TXINS

- TXBAL – Federal Corporation Income Tax Balance Due

- TXINS – Federal Corporation Tax Payment (i.e. an instalment payment)

If one sets up a pre-authorized debit (PAD) directly with CRA, one could see the following; CANADA TXD – this could relate to corporate tax or GST. ABCIT also stands for Alberta Finance Corporate Income Tax.

We hope you found this guide on CRA tax payments helpful with information on everything from how to pay CRA online to making GST payments. Still have questions? Remember, we’re here to help! Click here to speak with one of our accountants today and see what NowCPA can do for you. We’re here to make your life easier so you can spend less time working for your business and more time working on it. Don’t forget to check out our other blog posts – you’ll be happy you did.

Knowing how to pay your taxes is essential (but not always simple). But don’t worry, we’ve got you covered.

Refer to this guide anytime you need help with your CRA tax payments, and if you still need help we’re only a phone call or the click of a button away. Click here to speak with one of our expert accountants and take your business to the next level. Want to learn more? Click here for answers to other common questions for business owners.