Corporate Tax Obligations: What Are the Filing Requirements for a Corporation Operating a Small Business in Canada?

Posted on: February 13, 2024

Are you considering operating your small business through a corporation in Canada? Perhaps you’ve already incorporated. Either way, if you want to be in the Canada Revenue Agency (CRA)’s good books and avoid substantial fines and penalties in the process, it is absolutely critical to know and fulfill your obligations as the shareholder of a corporation in Canada by adhering to filing requirements.

In this article, we will discuss the most common payment and filing requirements for a corporation and corporate tax obligations along with their respective deadlines. Remember, knowing your corporate tax obligations is critical to your success. For simplicity we have separated the article into sections, some of which are not applicable to every corporation.

Corporate Income Tax Filing Requirements (all corporations)

Your corporation is considered a “person” for tax purposes (just like you are), and as the 1st section of the Income Tax Act states: “Income tax shall be paid on the taxable income for each taxation year of every person resident in Canada”. In other words, if your Corporation is in Canada, then it is required to pay Income Tax.

Your Corporation’s Year-end (or fiscal year-end)

Before you can know your filing deadline, you first need to know your corporation’s year-end.

Your corporation’s year-end is established by the year-end you select on your corporation’s first Income Tax Return. While the year-end can technically be any date up to 53 weeks after the date you incorporated, for practical purposes, you should select the last day of any month within the 53 week time frame. Be strategic about your decision and factor in your personal schedule, your corporation’s operational schedule, and your accountant’s schedule.

The Corporate Income Tax Return

The corporate income tax return (or T2) is quite different from the personal income tax return (or T1) because the corporation is required to report not only income activity (revenue and expenses), but also assets and liabilities. This is why filing a corporate tax return is a more involved process than a personal tax return. This is also why we highly recommend an experienced bookkeeper to stay current and organized. Our team can help you with this!

Income Tax Filing Deadline

All corporate income tax returns are due 6 months after the corporate year end. See the table below for the specific filing deadline for each month end.

| Year-end Date | Jan 31 | Feb 28 | Mar 31 | Apr 30 | May 31 | May 31 Jun 30 |

| Filing Deadline | Jul 31 | Aug 31 | Sep 30 | Oct 31 | Nov 30 | Dec 31 |

| Year-end Date | Jul 31 | Aug 31 | Sep 30 | Oct 31 | Nov 30 | Dec 31 |

| Filing Deadline | Jan 31 | Feb 28 | Mar 31 | Apr 30 | May 31 | Jun 30 |

Failure to file by your deadline will result in a penalty of 5% of your unpaid taxes, plus 1% of the unpaid tax for each complete month that the return is late, up to a maximum of 12 months. Note, these penalties can double if you have incurred this penalty in any of the three previous tax years.

Income Tax Payment Deadline

The income tax payment deadline is awkwardly due before the filing deadline of your tax return. If you are operating an active business, the payment deadline is 3 months after the year-end, otherwise it is 2 months after the year-end. If you are not proactive in filing your tax return early (i.e. within 3 months of the year-end), you may not know what payment to make by the payment deadline.

This is why we send reminders to our clients soon after their year-end, because we like to finalize the return before your payment deadline. Alternatively, we provide tax estimates so clients can avoid paying interest on late payments.

Failure to pay by your payment deadline will result in interest charges. The CRA will charge interest at the “prescribed rate” (which can be found on CRA’s website). At the time this article is written, the prescribed interest rate is 10%. That’s a lot of interest! This is definitely a corporate tax obligation you want to pay attention to.

If you have already filed a corporate income tax return, you may also be required to pay instalments. Click here to read our article on when instalments are required.

Corporate Income Tax Tips:

You will want to avoid interest and penalties. Here are some tips to help you stay afloat:

- Pay an experienced, qualified bookkeeper to stay on top of your books regularly

- Prepare early, and provide your accountant with documents shortly after your year-end date

- Treat your payment deadline as your filing deadline

- Stay on top of your instalments and income tax payments

Sales Tax (GST)

Every business should fully understand their sales tax obligations. As simple as it may sound, sales tax is a complex area. You should reach out to a tax professional to discuss your tax implications, especially if you are making any sales out of province, as you may have additional obligations with HST, PST, or other sales taxes.

How does it work?

As a consumer, you’ve certainly seen it: businesses are required to charge their customers GST on some (but not necessarily all) of their sales. But what you don’t see is that these businesses are required to pay (or remit) this GST to the CRA (more corporate tax obligations!). What you also may not realize is that these businesses can reduce the amount they are required to pay by claiming “Input Tax Credits” (ITCs), which is the GST that they have paid, as a credit on their GST return.

So who is required to charge/remit GST, and who isn’t?

Are your sales taxable?

The first question you need to determine is whether your sales (services and/or products) are taxable. Most sales are, but there are some exceptions such as sales of some medical practitioners. If you suspect you are in this category, you should confirm your thoughts with a tax professional.

If you are exempt, you are not required to register and you do not charge GST on your sales. This also means that you are not able to claim ITCs on any GST you may pay while running your business.

There are some scenarios where sales are considered “zero-rated”. This means that you are not required to collect/remit GST on those sales, but you they are still considered “taxable”, meaning you have the same requirements to register as regular taxable sales, and the same ability to claim ITCs on your GST returns. You heard that right! This means you can receive refunds for the GST that you pay, without the need to collect GST on your sales.

When should you register for GST?

Once you are registered, you are required to file GST returns and remit any taxes that you have collected (offset by those you have paid).

Early Registration

As long as your sales are less than $30,000 in 4 consecutive calendar quarters, you are not required to register for GST. But there may be reasons to register early. Perhaps you would like to claim your ITCs on your purchases, or you would like to adopt the practice early for practical reasons. Early registration is perfectly acceptable.

Your sales exceed $30,000 in a single calendar quarter

If your sales exceed $30,000 in a single calendar quarter, you are required to register no later than the day in which you exceeded the threshold.

Your sales exceed $30,000 over the previous four consecutive calendar quarters

If your sales exceed $30,000 over the previous four (or fewer) consecutive calendar quarters, but not in a single calendar quarter as noted above, then you are required to register no later than the beginning of the month after the end of the month following the quarter in which your sales exceed $30,000.

CRA has a table that illustrates the above found here.

When are GST returns and payments due?

Your GST return due date depends upon the filing frequency you select when you register. This table will help you understand your GST obligations.

| Selected Filing Frequency | Filing Deadline | Payment Deadline | Example: |

| Annual | 3 months after fiscal year-end | 3 months after fiscal year-end | Reporting period: Aug 31 Filing deadline: Nov 30 Payment deadline: Nov 30 |

| Quarterly | One month after the end of the reporting period | One month after the end of the reporting period | Reporting period: Mar 31 Filing deadline: Apr 30 Payment deadline: Apr 30 |

| Monthly (not recommended) | One month after the end of the reporting period | One month after | Reporting period: Jul 31 Filing deadline: Aug 31 Payment deadline: Aug 31 |

Our recommendation is to choose an annual or quarterly filing frequency. Annual provides the most flexibility with an extended filing and payment deadline, however, this often results in instalment obligations and may result in cash flow issues if businesses are not disciplined in setting aside funds to pay their sales tax. Quarterly remittances are ideal for businesses who have a bookkeeper that is staying on top of their books on a regular basis.

The penalties for filing a GST return late are equal to 1% of the balance owing, plus 25% of the balance owing for each month the return is overdue (up to 12 months).

Sales Tax Tips

To summarize. Here are some tips to help you navigate your sales tax obligations:

- Determine whether your sales are taxable

- Determine when you will register for GST

- Register annual if you are less regular with your books (but set aside cash to make your payments), otherwise, register quarterly.

Payroll

When you have employees (including yourself as an employee), you are required to deduct income taxes, CPP, and EI from their pay. These are often called “source deductions” (or “payroll withholdings”) – because they are deducted at source rather than paid at a later date.

Employer Contributions and Remittances

While you are required to withhold or deduct income taxes, CPP and EI from your employees’ pay, you are also required to make employer contributions to CPP and EI and include these with any source deduction with your remittance.

Source deductions, along with employer contributions are typically paid (or “remitted”) monthly (for a regular remitter). These payments are referred to as “remittances”.

How to calculate CPP, EI and income taxes

There are all sorts of software to help you out here. They’ll not only calculate the remittances, but they will automatically pay CRA, and your employees! Some of these include: Wagepoint (this is our personal favourite because of its easy-to-use interface), Payworks, Humi, and Payment Evolution.

If you would like to calculate this yourself, you can do so manually using CRA’s Payroll Deductions Online Calculator found here. You can use this to determine how much to deduct, and how much you as an employer are required to contribute. It will also let you know the net amount you can pay your employees. These tools are essential to making the maneuvering of your corporate tax obligations easier.

When do you have to pay source deductions

Most small businesses are considered regular remitters, which means that source deductions relating to a given period are due on the 15th of the month following the period in which they were paid.

Payroll example from start to finish

Let’s say that you need to pay your employees $10,000 in January. Here are the steps you should take.

Determine how much to “withhold”

- You can use CRA’s payroll calculator to determine the total income tax, CPP, and EI to withhold

- Once you have reached the employee screen, you can see the total deductions to be taken from their cheque and the net amount that you can pay your employee

- As you continue, you will be brought to the employer remittance summary which shows you the total remittance to make to the CRA

- The remittance should be made by the 15th of the following month, or in this case, February 15

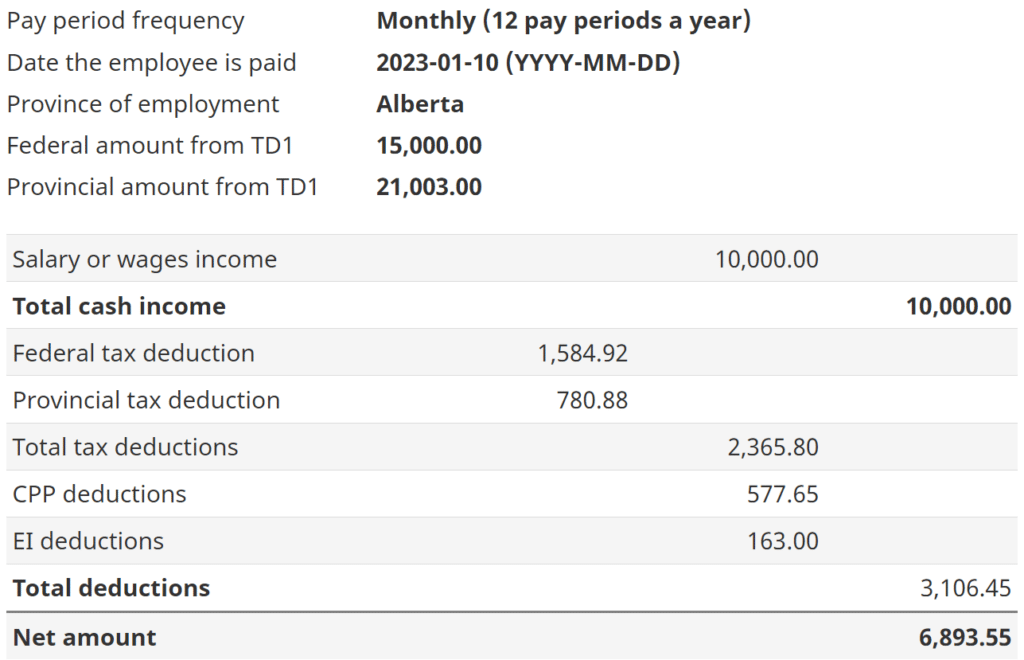

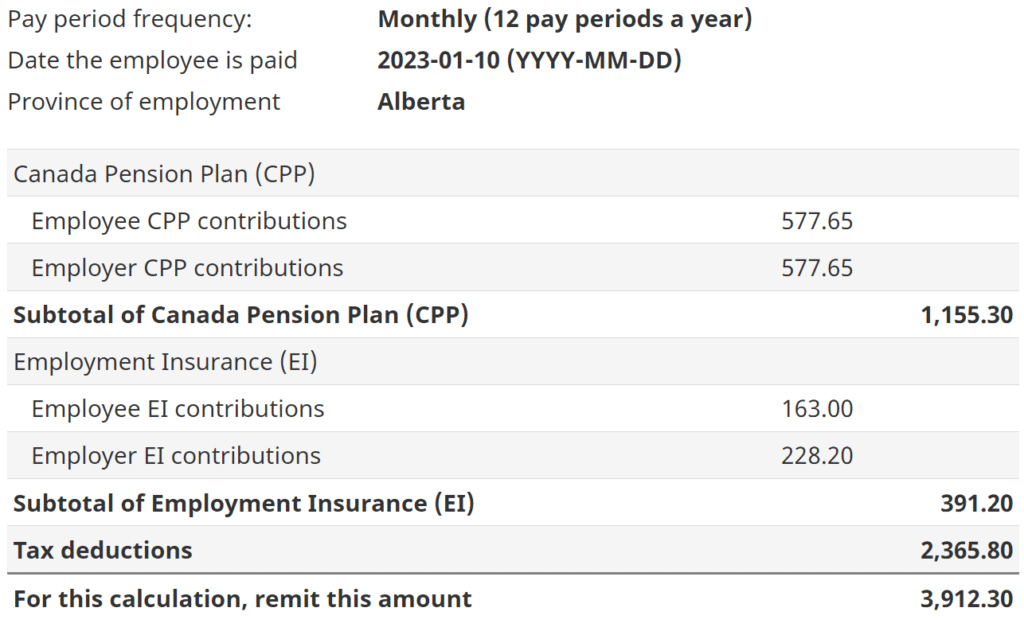

CRA’s Payroll Deductions Online Calculator

Employee amounts:

Total Remittance

Payroll Tip: Don’t be late!

Penalties for late payments are steep: for first-time offenders, it is 10% of the total remittance; otherwise it is 20% of the total remittance. This can add up fast!

As a director, you are personally liable for any source deductions not remitted to the government.

Bottom line: don’t be late – stay on top of your payroll obligations. This is also why we highly recommend payroll software to help you along the process.

T-slips and other filings

You have probably received a T4 from an employer. As an employer, you are required to file the T4s and provide these to your employees by the end of February.

There are other types of T-slips that you may need to file. Here are the the most common T-slip obligations that you may have, along with their respective due dates.

| T-slip Type | What is this for? | Due Date |

| T4 (Statement of Employment Income) | Any employers who pay employees in the year are required to file a T4 | February 28 (29th) |

| T5 (Statement of Investment Income) | Any corporations that pay interest or dividends (dividends paid to shareholders are the most common) | February 28 (29th) |

| T4A (Statement of Pension, Retirement, Annuity and Other Income) | Any business that paid pension, retirement, annuity or any other income, including fees for services. The most common requirement relates to businesses (not in the business of construction) that paid subcontractors during the year. | February 28 (29th) |

| T5018 (Statement of Contract Payments) | Any construction business that paid subcontractors in the year is required to file a T5018 | 6 months after your year-end date, or June 30 (if you file on a calendar year basis) |

Corporate Tax Obligations Summary

At the end of the day, it is important to know that as a business, you have a lot of filing requirements and corporate tax obligations – and the list seems to be only increasing over time.

We would be thrilled to take this off your plate so you can focus on what really matters – making money! Click here to book a quick meeting with one of our expert accountants and take that crucial first step to streamlining your business today.