Pricing Strategies for Small Businesses: 5 Steps to Success

Posted on: November 15, 2024

Ever tossed and turned at night, wondering if your business is charging the right price? It’s a tough balancing act. Too low, and you’re leaving money on the table. Too high, and you might scare off potential clients. Maybe you started out setting your rates based on what you made as an employee, or just by looking at what other businesses were charging. Sounds familiar, right?

But here’s the thing: pricing isn’t just about slapping on a number and hoping for the best. Your pricing should reflect the quality of your work, attract your ideal clients, grow your business, and keep you profitable. Knowing the different pricing strategies for small businesses (and why they are effective) is essential to your long-term success.

So, how do you actually get there and nail down strategic pricing?

Step 1: Stop Thinking Like an Employee

Our first stop in discussing pricing strategies for small business is actually an act of deprogramming. If you’re transitioning from employee to business owner, you might still be clinging to that hourly wage mindset. It’s understandable. After all, you’re used to thinking, “I earned $30 an hour when I worked for that company, and they charged clients $100. I can beat that! I’ll charge $75 an hour and rake in the clients.”

That’s a classic trap—charging too little, thinking it’s the easiest way to gain new business. But here’s the thing: You’re not just an employee anymore. You’re a business owner with overhead, bills, and the need to actually turn a profit. Remember, you’re not charging for your time; you’re charging for your business.

In various service industries, charging by the hour can be a straightforward, easy-to-understand pricing model, but if you want to grow, attract high-value clients, and command a premium, you need to go beyond just billing for time. Here’s why:

- You’re More Than Just Your Time: Your expertise, skill level, quality of work, and problem-solving ability all contribute to the value you provide. Charging solely by the hour doesn’t capture that.

- Clients Don’t Like Surprises: Ever had a client frown when you present an invoice higher than they expected? Hourly billing can sometimes lead to frustration because clients can’t easily predict their final cost. Fixed or value-based pricing can help solve that (we’ll get to that later).

- Long-Term Growth: Charging based on time often puts a ceiling on how much you can earn. You only have so many hours in a day, but you can always increase the value of your services.

Pricing is about more than just covering costs. It’s about recognizing the value you provide to clients—your expertise, reliability, credentials, experience, and quality of work.

Step 2: Understand Your Value (Unique Value Proposition) & Charge For It

It’s tempting to be the cheapest option in town, especially when you’re starting out. But if your prices are always scraping the bottom, you’re missing out on serious profits—and worse, you might be attracting the wrong kinds of clients. The “bargain hunters” are often the most difficult to work with and the least loyal.

Instead of racing to the bottom, focus on what makes you stand out and charge accordingly. What makes your business unique? Is it your attention to detail? Impeccable quality? Maybe it’s your problem-solving skills or customer service that keep clients stress-free and smiling? To price yourself properly, you need to understand the specific value you bring to the table—your unique value proposition (UVP)—and capitalize on it. Clients aren’t just paying for hours or a product; they’re paying for peace of mind, quality, and a positive experience.

Example: Think about the iPhone—people don’t buy an iPhone because they’ve calculated the exact cost of its parts. They buy it because they believe in the quality, performance, and brand. They feel they’re getting something special that justifies the higher price tag. Your services can work the same way. If your work is of high quality, you can—and should—charge for that added value.

Need help identifying your unique value proposition? Good decision making starts with reliable numbers and sound advice. Our CPAs offer more than just tax and accounting services. Schedule a free consultation today to find out where to start.

Step 3: Identify Your Ideal Customer & Their Values

To nail down pricing, you need to know how to identify your ideal customer. To do this, you need to understand what your ideal customer values. This can vary from customer to customer, but generally, people will pay more for high-quality work, professionalism, reliability, and timely completion of projects. So, this brings us to: Who is your ideal customer, and do their values align with your unique value proposition (UVP)?

Your UVP (established in step two) needs to align with your ideal customer. For example, if you specialize in high-end services or products, you’re placing an emphasis on quality and premium experience—communicate these values effectively (“we offer this!”), and you will attract people who share those values—your ideal customer!

Now, getting more in-depth, think about the customer who values quality and a high-end experience – what will they be looking for? They’ll want top-notch materials, exceptional service, fine craftsmanship, professionalism, etc. (all things that communicate quality and a premium experience). Start thinking like your customer: What do they care about the most? Do they want a quick turnaround? Do they prioritize premium quality? Maybe they value excellent communication and reliability. The better you understand your customer’s needs, the better you can structure your pricing to reflect that value.

Example: Think of it like dating – having shared values is essential to establishing a meaningful connection (building trust) and long-term compatibility (commitment). Otherwise, if these values don’t align (or at the very least aren’t clearly communicated), you find yourself asking questions like: Can they really give me what I need? Is this going to be worth it? How much am I willing to compromise? Should I have picked the rich surgeon instead? Just kidding. But you get the idea.

Step 4: Communicate Your Unique Value Proposition (UVP)

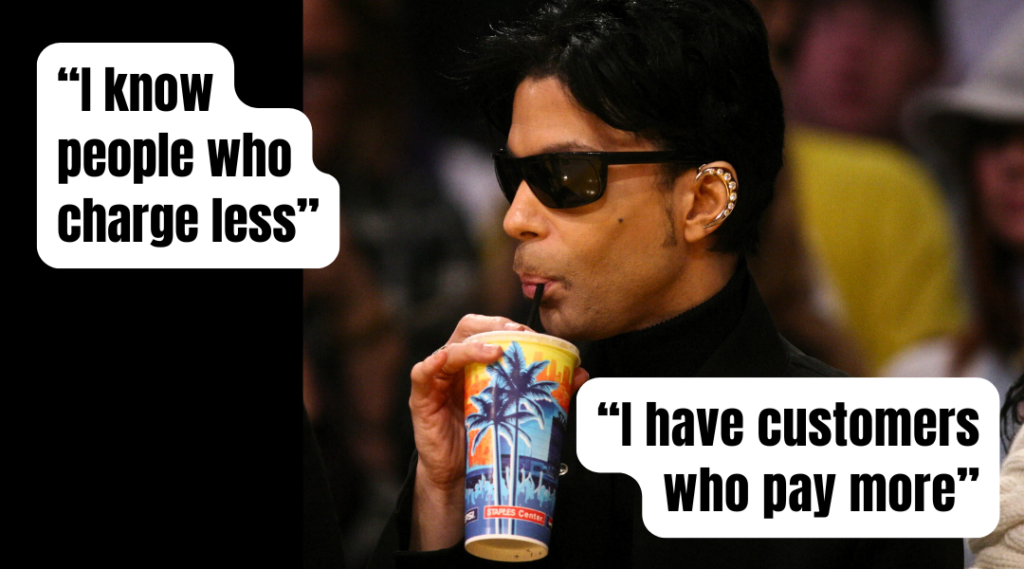

Okay, you’ve established your unique value proposition (UVP) and ideal client. But how do you communicate that to clients in a way that makes them willing to pay more? Here’s where pricing strategies for small business can be both an art and a science.

- Don’t Be Afraid of Premium Pricing: There’s a misconception that being the cheapest will always win you clients. Spoiler alert: it won’t. Clients who prioritize quality are often suspicious of low prices. They want to know they’re getting what they pay for. If you set your prices too low, you’ll attract clients who want a bargain, not clients who appreciate high-end work. Remember, your pricing doesn’t just tell clients what they’ll be paying—it also tells them what they’ll be getting.

- Show, Don’t Just Tell: It’s one thing to say you’re good at what you do; it’s another to prove it. Show clients examples of your best work, showcase your portfolio, have past clients vouch for you in testimonials, and walk them through the details of how what you offer ensures top-notch results. This builds trust and justifies your higher price point.

- Be Transparent: No matter your pricing structure, be crystal clear with your clients about what’s included in your pricing. Hidden costs or surprises will erode trust faster than anything else. Break down what goes into your pricing so people know what they’re paying for. However, don’t make the mistake of getting too in-depth – it can raise questions that you will then be expected to justify and, as a professional, it can be tough to communicate to someone exactly why certain costs/evils are necessary (kind of like explaining to a child why they need to eat their broccoli – just trust us, it’s good for you). Never compromise on (or feel the need to justify) pricing that could compromise your safety, reputation, values, or service.

Communication is key. You need to clearly explain why your services cost what they do, and how that price reflects the value they’ll receive. For example, if your clients are asking why you charge more than a competitor, you can point out that your pricing includes high-quality materials, experienced/skilled team members, warranty, an unwavering commitment to meeting deadlines, etc. When we’re talking about pricing strategies for small businesses, clients need to understand the full picture in order to see your price as “worth it.” Finding the right pricing has the power to establish you as highly valuable in your niche.

Step 5: Pick a Pricing Strategy

So, what are some of the pricing strategies for small businesses? There are a few pricing strategies to choose from, depending on your goals, niche, and type of clients you want to attract:

1. Hourly Pricing: This is the simplest model—clients pay for the time you spend on the job. It works well for when the scope of work is hard to define at the outset. However, it’s not always the best for long-term profitability since it limits your earning potential to the hours you can work.

2. Fixed Pricing: With fixed or flat-rate pricing, you charge one set sum for the entire job, regardless of how long it takes. This method works well when the scope and timeline are clear, and it gives clients the security of knowing exactly what they’ll pay. This is often more attractive to clients because they won’t get hit with surprise costs at the end.

3. Value Based Pricing: This one’s a game-changer for those ready to scale up. Value-based pricing means you charge based on the outcome you’re delivering to the client, not just the time and materials. It’s the difference between charging for a website versus charging for a website that will increase the client’s sales. Clients are willing to pay more when they see the end result is worth the investment.

Your pricing strategy isn’t just about making money in the short term—it’s about achieving your long-term business goals. Want to focus on high-end jobs or services? Set your prices to reflect that. Trying to scale your business and hire more staff? Build those costs into your pricing model. Think of your pricing as a roadmap to where you want your business to go.

- If You Want to Grow: Higher margins will allow you to invest in growth—whether that’s hiring additional staff, upgrading your tools or software, or marketing your services to a broader audience.

- If You Want to Work Less: Want to spend more time away from day-to-day operations? Charging more allows you to work fewer hours without sacrificing income, giving you the freedom to focus on higher-level business strategy or simply enjoy more time off.

Not sure what pricing strategy is best for your business? Start your journey to profitability off right and book a free call with NowCPA to get started with one of our experienced CPAs.

How to Know When To Increase Your Prices

Most business owners undercharge for way too long. But there comes a point where raising your rates is not only appropriate—it’s necessary. Here are some signs that it’s time to bump up your pricing:

- You’re Always Busy: If you’re booked solid and constantly turning away work, congratulations! But that’s also a sign that you’re probably undercharging. When demand is high, you can afford to raise your rates. If you have a waiting list of clients, it proves your services are in high demand – which is another opportunity to increase your prices. Raising your pricing when you’ve got work to spare also helps prune your clientele to better match your ideal client by diverting those bargain-hunters.

- You’re Struggling to Stay Profitable: If you’re working long hours but still barely scraping by, your pricing model likely needs an overhaul. Raising your prices can help you achieve better margins and give you more breathing room.

- You’re Adding More Value: As you gain experience, improve your skills, or invest in better tools and systems, your value to clients increases. Your prices should reflect that. Or, if you’ve expanded your service offerings, such as adding specialized services or using advanced techniques, you can charge a premium for these additional features.

- Rising Costs & Inflation: If your overall cost of materials, labour, or overhead has increased, it’s necessary to adjust your pricing accordingly to maintain profitability.

Strategic Pricing: More Than Just Numbers

Pricing is the backbone of your business. It determines your clients, your profits, and whether you’re growing or just getting by. Don’t fall into the price-cutting game—build your pricing around the value you bring.

Learning pricing strategies for small business can be tricky, but it’s a strategic necessity. Click here to schedule a consultation with one of our expert CPAs about accounting, financial strategy, or if you have more questions about pricing strategies for small business. For further resources, click here learn more about what NowCPA offers small business owners or check out our blog.